SA Fine-Tuned Trading (Pty) Ltd

PROJECT NAME / SITE:

SA Fine-Tuned Trading (Pty) Ltd

--------------------------------------------------------

Business Owner (s):

Mr Mlungisi Sonwabile Bushula (Managing Director)

--------------------------------------------------------

Business Registration Number:

2013/144235/07

--------------------------------------------------------

Business Address:

411 Spring Road, Stutterheim, Eastern Cape, South Africa, 4930

Business & Social Media Links:

--------------------------------------------------------

When was your business established?

2020

Sector:

Biodiversity Mixed Farming Enterprise – Wildlife, Agriculture, Forestry & Tourism stocking

Current Investment Sought:

R15,000,000 for operational expansion and wildlife

Current Valuation:

R50M (based on secured government funding, land rights, and projected revenue streams)

Use of Funds:

Wildlife stocking programme, operational capital, marketing, equipment, and technology systems

Expected ROI:

6-8x over 5-7 years via diversified biodiversity economy operations

Environment

- Rehabilitate 4,200 hectares of degraded land to natural ecosystem functions.

- Achieve carbon neutrality through renewable energy and sequestration practices.

- Restore indigenous wildlife populations supporting regional conservation goals.

Social Impact

- 70% target for women in processing and value-addition activities

- Youth training and mentorship programmes with 50+ participants annually

DESCRIPTION OF THE SA FINE-TUNED TRADING (PTY) LTD

South Africa is the world's third most biologically diverse country and, therefore, has one of the largest natural capital assets. The biodiversity economy represents one of South Africa's most promising economic sectors, leveraging the country's position to create sustainable economic value whilst advancing conservation and rural development objectives.

South Africa's wildlife ranching sector has experienced remarkable expansion, now encompassing 17- 20.5 million hectares, equivalent to 14-17% of the country's total land surface area. This expansion has been facilitated by progressive legislation, including the Game Theft Act (No. 105 of 1991), which granted private landowners ownership rights over wildlife under conditions of adequate fencing.

The forestry sector represents another significant component of SAFTT's operations. The forest sector (forestry and forest products) contributes about 1% to the GDP, with an afforested area of about 1.27 million hectares or about 1% of the total South African land area. Some 20,000 workers are employed in sawmilling, 6,000 in the timber board and 2,200 in the mining timber industries, while a further 11,000 workers are employed in miscellaneous jobs in forestry.

The global safari tourism market size was valued at USD 32.1 billion in 2023 and is poised to grow from USD 33.96 billion in 2024 to USD 53.32 billion by 2032, growing at a CAGR of 5.8% during the forecast period (2025-2032), demonstrating the substantial growth potential within the sector.

Mission Statement:

To harness South Africa's abundant renewable natural resources, intellectual capacity, and strategic networks to contribute meaningfully to the Eastern Cape's economic and regional development whilst advancing biodiversity conservation and rural transformation.

Vision Statement:

To establish a world-class biodiversity economy enterprise that exemplifies sustainable resource utilisation, community empowerment, and conservation excellence, serving as a catalyst for responsible development within the Greater Addo-Amathole Biodiversity Economy Node.

Legal Form of Business:

☑ Private Company (Pty) Ltd

Traction

- R20 million secured funding through the DFFE-EPIP programme

- 4,200 hectares of prime conservation land under the lease agreement

- Environmental Impact Assessment approved (April 2024)

- Member of Greater Addo-Amathole Biodiversity Economy Node

- Established forestry operations with an existing client base

- 100% PDI ownership with government transformation support

The Problem & Our Solution

The Problem

- The Eastern Cape has South Africa's highest unemployment rate at 36.5%

- Limited participation of previously disadvantaged individuals (PDIs) in the lucrative wildlife economy

- Degraded state land requiring rehabilitation and sustainable management

- Lack of transformation in the R4.3 billion South African wildlife industry

- Climate change impacts requiring adaptive land management practices

Our Solution

- A fully integrated biodiversity economy enterprise combining wildlife, agriculture, forestry, and tourism

- 100% Black ownership with demonstrated government support and transformation credentials

- Sustainable land rehabilitation, converting degraded agricultural land into productive conservation areas

- Job creation in rural communities through diverse economic activities

- Climate-resilient farming practices with renewable energy systems

With 4,200 hectares of diverse habitat and R20 million in committed infrastructure funding, SAFTT provides a scalable model for biodiversity economy development whilst generating sustainable returns across multiple revenue streams.

Our Products

Wildlife & Hunting Operations:

- Professional hunting packages for Big Five and plains game species

- Photographic safari experiences and wildlife viewing

- Live animal sales for breeding programmes and conservation initiatives

- Wildlife management and breeding services

Accommodation & Tourism:

- 20-bed eco-friendly hunting lodge with luxury amenities

- Corporate retreat and conference facilities

- Cultural tourism experiences showcasing local heritage

- Adventure tourism activities, including river access

Livestock & Agriculture:

- 280-300 head cattle ranch across 900 hectares

- 100 Boer goats, 100 Dohne-Merino sheep, 100 free-range chickens

- 100 hectares of irrigated crop production (lucerne, chilli peppers)

- Organic and sustainable farming practices

Forestry Operations:

- Commercial timber harvesting and processing

- Value-added products, including poles, laths, and transmission materials

- Alien invasive species management and Indigenous restoration

- Supply contracts with established clients (NCT Forestry, Sappi Saiccor)

Meat Processing:

- EU-standard meat processing facility for game and livestock

- Traditional biltong and dried meat product lines

- Supply to premium restaurants, hotels, and export markets

- Artisanal and speciality meat products

Value-Added Services:

- Training and skills development programmes

- Community development initiatives

- Conservation consulting and management services

All operations are certified within the Greater Addo-Amathole Biodiversity Economy Node, ensuring premium market positioning and preferential access to support programmes.

Market Analysis

Target Segments

International Hunting Tourists: High-net-worth individuals from North America and Europe seeking authentic African hunting experiences,

Photographic Safari Market: The growing eco-tourism segment values sustainable, community benefiting experiences.

Domestic Tourism: Affluent South African families and corporate clients seeking premium wildlife experiences and accommodation

Forestry & Timber Clients: Established relationships with major processors requiring a consistent, sustainable timber supply

Premium Food Market: Restaurants, hotels, and retail outlets demanding ethically sourced, traceable game meat and traditional products

Market Size & Growth

- Southern Africa safari tourism market: USD 11.70 billion (2023), projected CAGR of 9.8% to 2030

- South African hunting tourism: USD 250 million annually, supporting 17,000+ jobs

- Wildlife ranches generate an average revenue of USD 404/hectare vs USD 131/hectare for traditional livestock farms.

- Live game trade: R4.3 billion annually in South Africa

- Global timber market: USD 992.43 billion (2024), projected CAGR of 4.7%

Competitive Edge

| Competitive Factor | Traditional Operators | SAFTT Advantage |

| Government Support | Limited access | Direct DFFE partnership, R20M committed funding |

| Transformation | Minimal PDI participation | 100% Black ownership, preferential procurement |

| Market Access | Standard commercial terms | Biodiversity Node certification, preferential trade access |

| Revenue Diversification | Single-focus operations | Six integrated revenue streams across sectors |

| Location | Established but saturated | Strategic Eastern Cape positioning, proximity to airports |

Business Model

Revenue Streams

Wildlife Hunting Operations (45%): Premium Big Five and plains game hunting packages, average R300,000 per client

Accommodation & Tourism (25%): Lodge accommodation, photographic safaris, corporate retreats

Forestry Operations (15%): Timber harvesting, processing, and value-added products

Meat Processing (8%): Game and livestock processing, traditional products, export sales

Live Animal Sales (4%): Breeding stock for conservation programmes and game ranches

Agriculture & Consulting (3%): Crop production, training services, conservation consulting

Unit Economics Snapshot

- Big Five Hunting Package:

- Cost: R120,000

- Selling Price: R400,000

- Gross Margin: 70%

- Lodge Accommodation (per person/night):

- Cost: R800

- Selling Price: R2,500

- Gross Margin: 68%

- Overall Business Gross Margin: 60-68%, depending on revenue mix

Operational History & Traction

| Year | Revenue | EBITDA | Key Highlights |

| 2020 | R500,000 | -R300,000 | Business established, initial forestry operations |

| 2021 | R1,200,000 | -R100,000 | Land lease secured, EIA process commenced |

| 2022 | R2,800,000 | R400,000 | DFFE funding approved, infrastructure planning |

| 2023 | R4,500,000 | R1,200,000 | EIA-approved construction contracts awarded |

| 2024 (est) | R8,000,000 | R2,400,000 | Infrastructure development, biodiversity node participation |

Current Achievements:

- R20 million DFFE-EPIP funding secured and committed

- Environmental Impact Assessment approved April 2024

- 4,200 hectares under a long-term lease agreement with DALRRD

- Greater Addo-Amathole Biodiversity Economy Node participation

- Established forestry client base with multi-year contracts

- Award recognition: 2017 & 2019 National Youth in Agriculture Awards

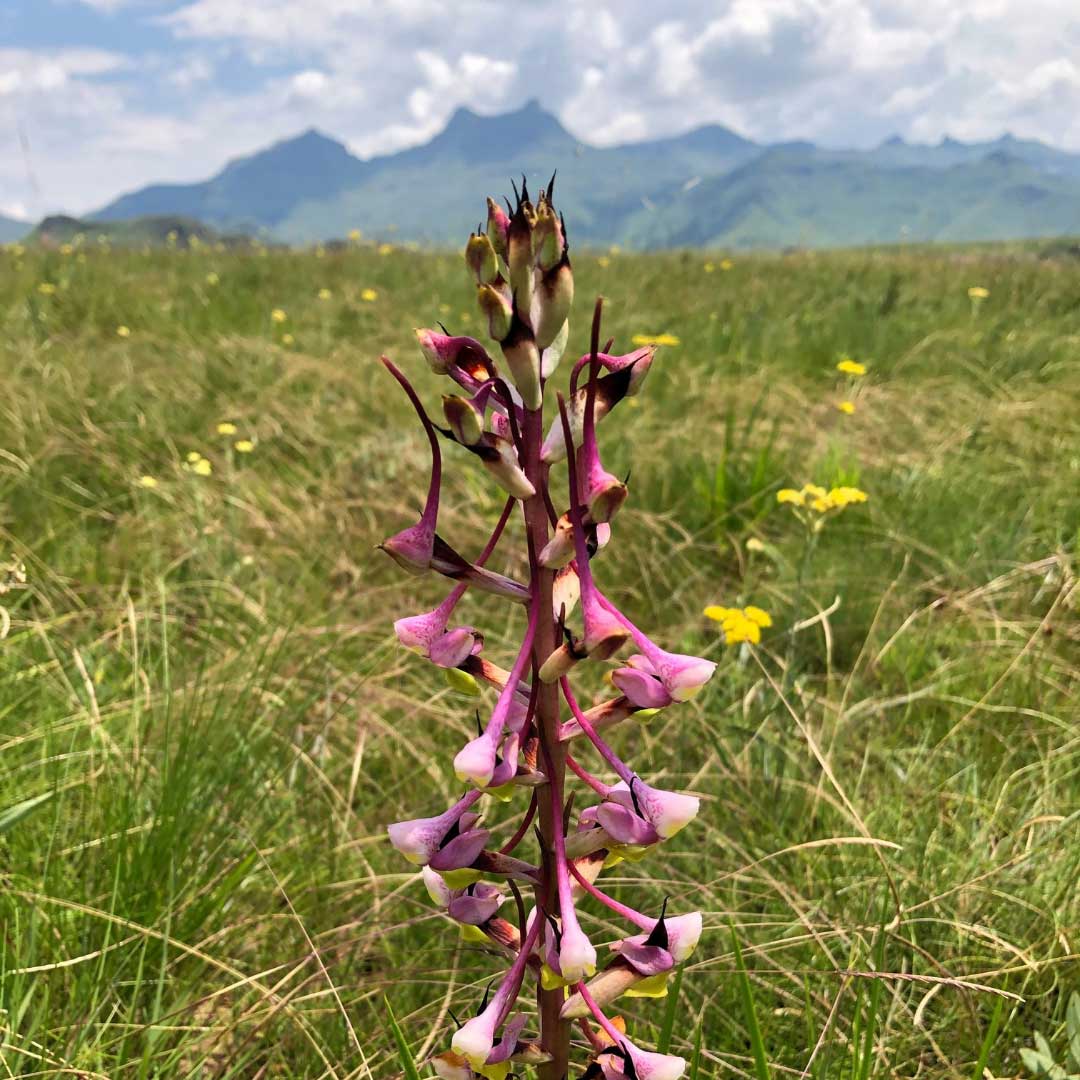

Biodiversity and Conservation Priorities

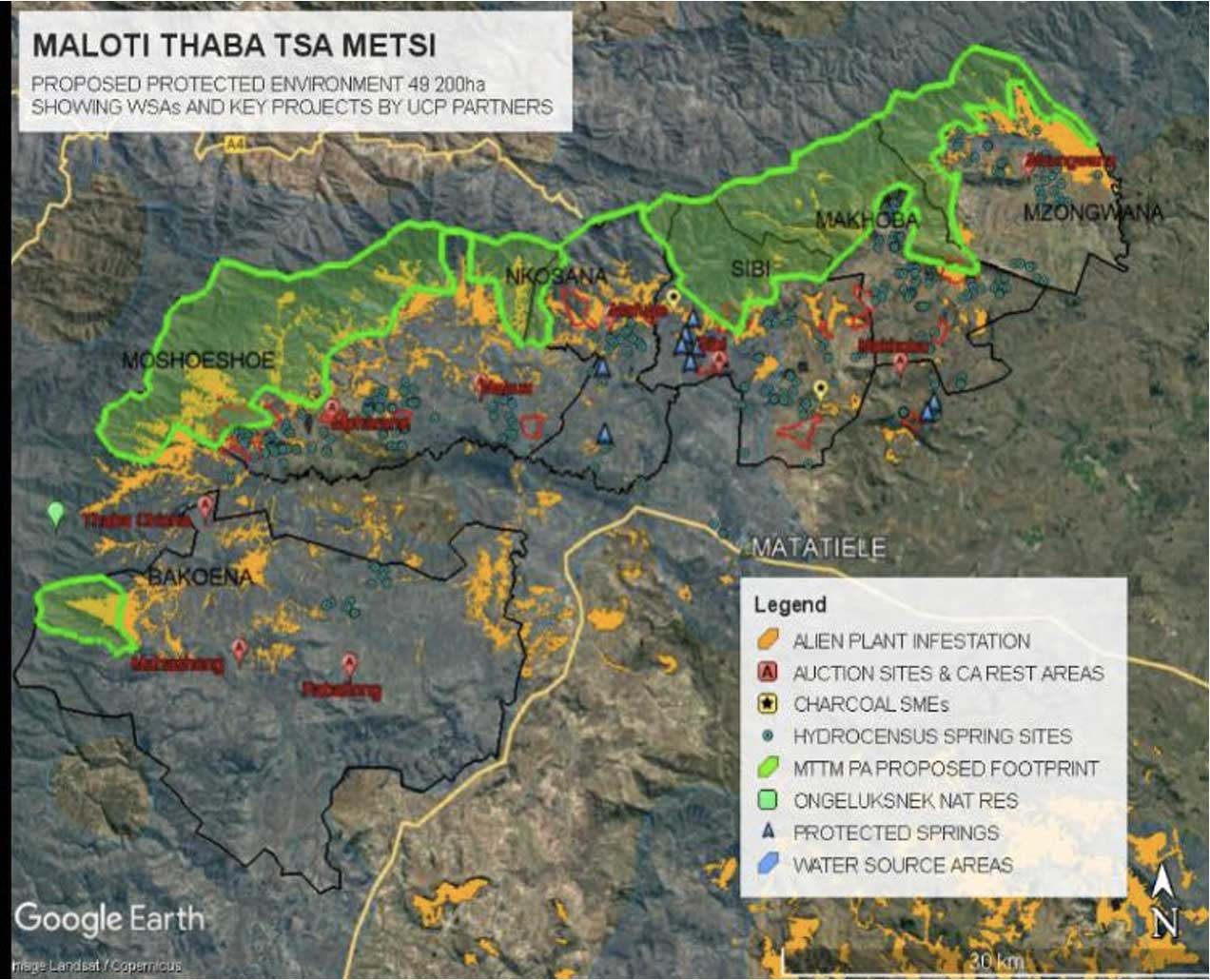

SAFTT's operations actively contribute to biodiversity protection and ecosystem restoration:

Wildlife Conservation & Restoration

- Reintroduction of Indigenous game species to historical ranges, including buffalo, rhino, and antelope

- Population management aligned with ecological carrying capacity

- Contribution to regional wildlife corridors connecting Addo Elephant National Park and surrounding reserves

- Science-based conservation management practices with monitoring protocols

Habitat Rehabilitation

- Conversion of 3,000+ hectares from degraded agricultural land to natural grassland and bushveld ecosystems

- Alien invasive species control across the entire 4,200-hectare property

- Indigenous vegetation restoration using local seed sources

- Establishment of wildlife corridors and buffer zones

Climate Resilience & Carbon Management

- 100% renewable energy systems (solar, wind, biogas) for off-grid operation

- Carbon sequestration through grassland restoration and sustainable forestry practices

- Water conservation via rainwater harvesting, greywater recycling, and efficient irrigation

- Sustainable building materials and construction practices

Community-Based Conservation

- Training programmes for local communities in wildlife management and eco-tourism

- Traditional ecological knowledge integration with modern conservation practices

- Preferential employment and procurement from surrounding communities

- Educational programmes for local schools focusing on biodiversity and entrepreneurship

Expansion Strategy

Near-Term (12-18 months):

- Complete wildlife stocking programme with Big Five introduction

- Launch hunting lodge operations with an initial 50% occupancy target

- Establish a processing facility for game meat and traditional products

- Develop international marketing partnerships and booking platforms

Mid-Term (2-3 years):

- Expand accommodation capacity to 40 beds with conference facilities

- Secure international hunting concessions and outfitter partnerships

- Launch photographic safari and eco-tourism packages

- Develop organic certification for agricultural products

Long-Term (3-5 years):

- Replicate the model across additional Eastern Cape properties

- Establish SAFTT as the leading transformation operator in the wildlife industry

- Develop a training academy for biodiversity economy skills development

- Explore carbon credit and ecosystem services revenue opportunities