PROJECT NAME / SITE:

Capstone Game Farming Enterprise

--------------------------------------------------------

Business Owner (s)

Ellina Nomanesi Ndevu (Director / Owner)

--------------------------------------------------------

Business Registration Number

2001/048909/23

--------------------------------------------------------

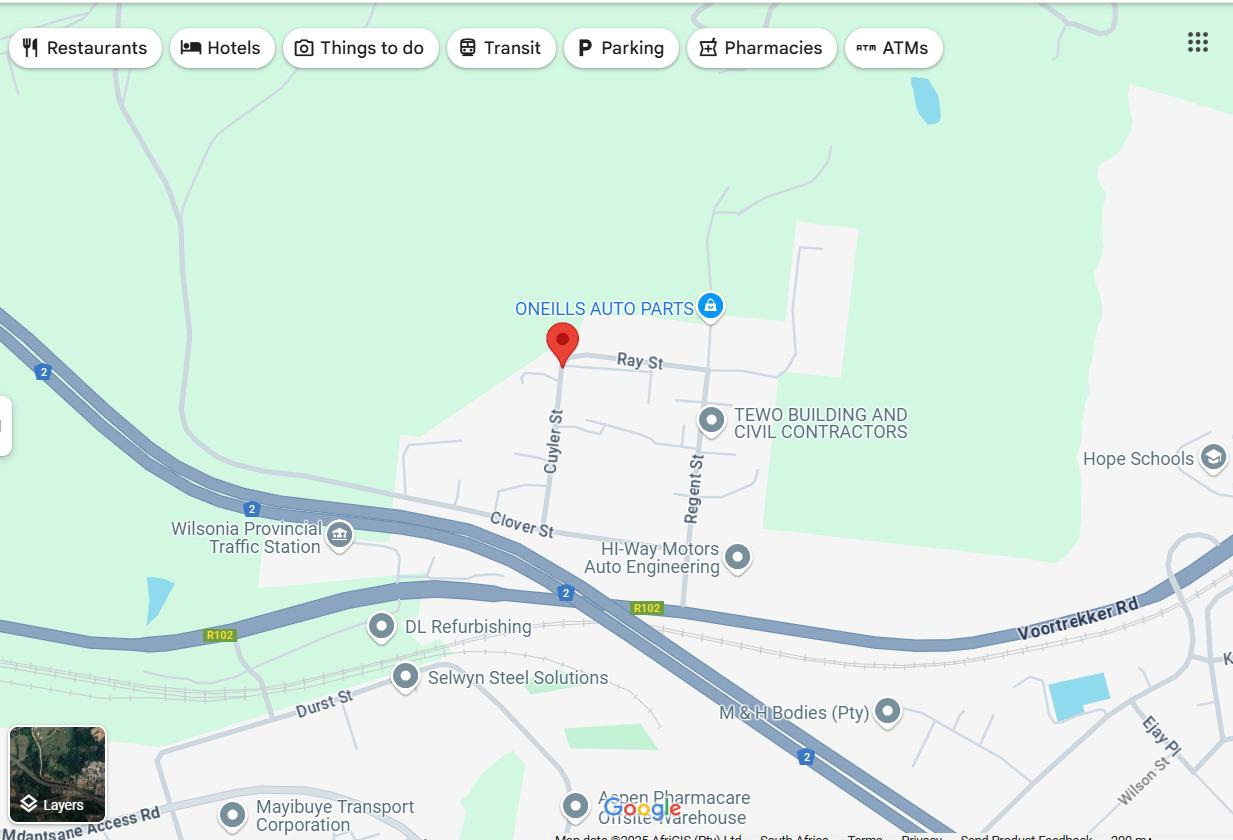

Business Address

No. 3 Cuyler Street, Eureka, East London, 5247, Eastern Cape, South Africa

Business Established

2018 (Company registered 2001)

--------------------------------------------------------

Legal Structure

Close Corporation

--------------------------------------------------------

Current Investment Sought

R10,000,000 for business expansion and infrastructure development

--------------------------------------------------------

Current Valuation

R13.1 million (based on current assets and operational capacity)

Use of Funds

Abattoir development, accommodation expansion, game management enhancement, equipment acquisition, and working capital

--------------------------------------------------------

Expected ROI

6-8x over 5-7 years via international market expansion and value-added processing

DESCRIPTION OF THE CAPSTONE GAME FARMING ENTERPRISE

Industry Overview & Market Context:

The South African wildlife economy represents one of the continent's most dynamic and rapidly expanding economic sectors, with trophy hunting alone contributing over US$341 million annually to the national economy whilst supporting more than 17,000 employment opportunities. This extraordinary growth trajectory reflects the industry's evolution from traditional farming practices to sophisticated, internationally integrated tourism and conservation enterprises that deliver exceptional economic, social, and environmental returns.

Research conducted by North-West University's Tourism Research in Economics, Environs and Society (TREES) unit demonstrates that the hunting industry contributes just over R15 billion to South Africa's economy annually when accounting for accommodation, transport, catering, processing, permits, fees, and trophy fees. The Eastern Cape has emerged as a premier destination within this sector, offering diverse ecosystems, malaria-free environments, established transport infrastructure, and favourable regulatory frameworks supporting sustainable wildlife utilisation.

Company Foundation & Leadership:

Capstone Game Farming Enterprise was formally established in 2018, building upon the solid foundation of Capstone 1248 CC, a company originally registered in 2001 under registration number 2001/048909/23. This strategic evolution reflects the leadership's commitment to developing a specialised, world-class wildlife enterprise that exemplifies excellence in both business performance and transformation leadership.

The enterprise operates under the visionary leadership of Ms Ellina Nomanesi Ndevu, whose entrepreneurial excellence and passionate commitment to wildlife economy development have positioned Capstone as a beacon of successful transformation within the traditionally male-dominated hunting industry. Ms Ndevu's leadership is complemented by an experienced management team, including Ms Nandipha Nomatyindyo as Business Manager, bringing extensive qualifications in Land and Agrarian Studies, Advanced Management, and Business Development, and Mr Brendan Moorcroft as Farm Manager, contributing 17 years of farming experience and professional hunting expertise with dangerous game endorsement.

Mission Statement:

To operate a premier wildlife enterprise at full operational capacity, creating sustainable employment opportunities for 50 individuals by 2035 whilst delivering exceptional hunting and eco-tourism experiences that contribute meaningfully to biodiversity conservation, rural economic development, and South Africa's transformation agenda.

Vision Statement:

To establish Capstone as the Eastern Cape's leading Black woman-owned game farming enterprise, recognised internationally for excellence in sustainable wildlife management, exceptional client service delivery, and transformative community impact that demonstrates the extraordinary potential of historically disadvantaged individuals in South Africa's wildlife economy.

Strategic Location & Infrastructure:

Capstone's exceptional competitive positioning stems from its strategic location across 1,590 hectares of prime Eastern Cape wilderness, encompassing the combined Garland No. 181 and Kirby No. 174 farms near Stutterheim. This remarkable property portfolio offers several critical advantages, differentiating Capstone from competitors and enhancing its appeal to discerning international clientele.

The property's unique topographical diversity spans from dense, traditional African bushveld to expansive open plains, providing varied hunting experiences that accommodate different species, hunting preferences, and client requirements. This diversity enables Capstone to offer both traditional stalking experiences in challenging terrain and open-country hunting that appeals to clients preferring different hunting methodologies.

Accessibility represents another crucial competitive advantage, with the property benefiting from dual access via both the N2 and N6 national highway networks. This positioning places Capstone within convenient travelling distance of East London's international airport and harbour facilities, significantly enhancing accessibility for international clients whilst reducing logistical complexity and associated costs.

Comprehensive Service Portfolio

Capstone's sophisticated business model encompasses multiple complementary service offerings that create diverse revenue streams whilst enhancing client satisfaction and operational resilience:

Premium Trophy Hunting Services: The enterprise specialises in providing world-class trophy hunting experiences featuring over 20 game species, including the prestigious Cape Buffalo. Professional hunting services include qualified professional hunters, experienced tracking teams, trophy preparation, and comprehensive logistical support, ensuring exceptional client experiences that consistently exceed international standards.

Luxury Accommodation Services: Capstone operates a comprehensive 24-bed luxury lodge facility featuring entertainment areas, a swimming pool, specialised amenities for guests with disabilities, and full catering services. The accommodation offering includes both group self-catering arrangements at R3,000 per night and full-service packages at R2,800 per person per night, catering to diverse client preferences and budgets.

Game Meat Production & Processing: The enterprise operates sustainable game meat production partnerships with local abattoirs, selling premium game meat at R31 per kilogram. This revenue stream provides additional income whilst supporting local food systems and ensuring optimal utilisation of harvested game resources.

Traction

- R801,091 quarterly revenue (Q1 2025)

- 1,590-hectare prime hunting property with 20+ game species including Cape Buffalo

- 80% client retention rate with established international clientele

- 24-bed luxury accommodation facility with specialised PWD amenities

- 16 permanent staff expanding to 160+ during peak seasons

- 100% Black woman-owned enterprise with strong transformation credentials

The Problem

- Limited transformation in South Africa's wildlife economy sector

- Lack of value-added processing in the game meat industry

- Insufficient premium hunting destinations owned by historically disadvantaged individuals

- High unemployment in rural Eastern Cape communities

- Fragmented wildlife tourism offerings lacking comprehensive service integration

Our Solution Capstone addresses these challenges by offering:

- Authentic, premium African hunting experiences led by an experienced Black woman entrepreneur

- End-to-end wildlife tourism services from hunting to luxury accommodation

- Value-added game meat processing creates additional revenue streams

- Meaningful employment opportunities for local communities

- Comprehensive wildlife management supporting conservation objectives

Our Products & Services

Capstone operates a diversified wildlife enterprise offering:

Primary Services:

International Trophy Hunting: Premium hunting packages (R12,000-R220,000) featuring 20+ game species, including Cape Buffalo, targeting affluent international clients

Luxury Accommodation: 24-bed lodge facility with self-catering (R3,000/night) and full-service options (R2,800/person/night)

Game Meat Sales: Current sales at R31/kg to local abattoirs with expansion planned for value-added processing

Planned Services (Post-Investment):

Premium Game Meat Processing: Value-added products targeting retail and restaurant markets

Eco-Tourism Experiences: Game viewing and cultural experiences for non-hunting tourists

Corporate & Conference Services: Specialised venue for corporate events and team building

Educational Programs: Wildlife conservation and cultural heritage experiences

Market Analysis

Target Segments

International Trophy Hunters (85% of revenue): Affluent clients aged 35-65 from the USA (40%), EU (45%), and UK (15%)

Domestic Recreational Hunters (15% of revenue): South African residents seeking biltong hunting and recreational experiences

Eco-Tourism Market (Growth opportunity): International and domestic tourists seeking authentic African experiences

Corporate Clients: Companies requiring unique venues for events and team building

Market Size & Growth

- The South African hunting industry contributes US$341 million annually, supporting 17,000+ jobs

- Eastern Cape is positioned as the premier malaria-free hunting destination

- Wildlife ranching auction values grew from R93 million (2005) to R1.8 billion (2014)

- Trophy hunting contributes R15 billion annually to the South African economy

Competitive Edge

| Competitor Type | Limitation | Capstone Advantage |

| Traditional Operators | Limited transformation credentials, basic facilities | 100% Black woman-owned, luxury amenities, PWD accessibility |

| Local Competitors | Smaller scale, limited services | Comprehensive service offering, international marketing, and prime location |

| International Brands | High costs, impersonal service | Authentic cultural experience, competitive pricing, personalised service |

Business Mode

Revenue Streams

Trophy Hunting Operations (60%): International and domestic hunting packages with an average value of R65,000 per international client

Accommodation Services (25%): Lodge operations serving hunting clients and eco-tourists

Game Meat Processing (10%): Value-added meat products for retail and commercial markets

Eco-Tourism & Corporate Services (5%): Diversified tourism offerings for broader market appeal

Unit Economics

International Hunting Package: Average R65,000 with 55% gross margin

Accommodation (per night): R2,900 average rate with 60% gross margin

Processed Game Meat: R180/kg (vs. R31/kg unprocessed) with 70% gross margin

Customer Retention Rate: 80%, demonstrating exceptional service quality

Operational History & Traction

| Year | Revenue | Key Highlights |

| 2022 | R4,357K assets | Foundation establishment, initial operations |

| 2023 | R3,729K income | International client base development |

| 2024 | R2,889K income | Infrastructure improvements, service enhancement |

| 2025 Q1 | R801K revenue | Strong seasonal performance, operational optimisation |

Operational Strengths:

Strategic Location: 1,590 hectares with dual highway access (N2/N6)

Diverse Infrastructure: 24-bed lodge, entertainment areas, specialised facilities

Experienced Team: Professional hunters, experienced management, skilled staff

Conservation Compliance: Full regulatory compliance with environmental authorities

Biodiversity and Conservation Priorities

Capstone's operations actively contribute to biodiversity conservation through:

Sustainable Wildlife Management

- Scientific population monitoring and sustainable harvest quotas

- Breeding programmes enhancing genetic diversity

- Habitat management supporting 20+ Indigenous species

- Professional veterinary partnerships ensuring animal health

Ecosystem Enhancement

- Habitat restoration across 1,590 hectares

- Water point development supporting wildlife populations

- Vegetation management promoting ecological diversity

- Anti-poaching security protecting valuable wildlife assets

Conservation Partnerships

- Collaboration with DFFE, ECPTA, SANParks, and SANBI

- Participation in wildlife conservation programs

- Educational initiatives promoting conservation awareness

- Research partnerships supporting conservation science

Expansion Strategy

Phase 1 (Year 1-2): Infrastructure Development

- Construct a dedicated game meat processing facility

- Expand accommodation capacity from 24 to 36 beds

- Enhance anti-poaching security systems

- Develop eco-tourism infrastructure

Phase 2 (Year 2-3): Market Expansion

- Launch premium game meat product lines

- Develop corporate and conference services

- Expand international marketing efforts

- Establish distribution partnerships

Phase 3 (Year 3-5): Market Leadership

- Achieve R15+ million annual revenue

- Establish a regional market leadership position

- Develop additional properties or partnerships

- Create employment for 50+ permanent staff

Financial Projections (2025-2028)

| Metric | 2025 | 2026 | 2027 | 2028 |

| Revenue | R3,200,000 | R8,000,000 | R11,300,000 | R14,600,000 |

| Gross Margin | 53.0% | 58.4% | 60.3% | 61.2% |

| EBITDA | R28,000 | R1,170,000 | R2,065,000 | R2,850,000 |

| Net Profit | (R92,000) | R482,400 | R1,076,400 | R1,605,600 |

| Employees | 16 | 30 | 40 | 50+ |